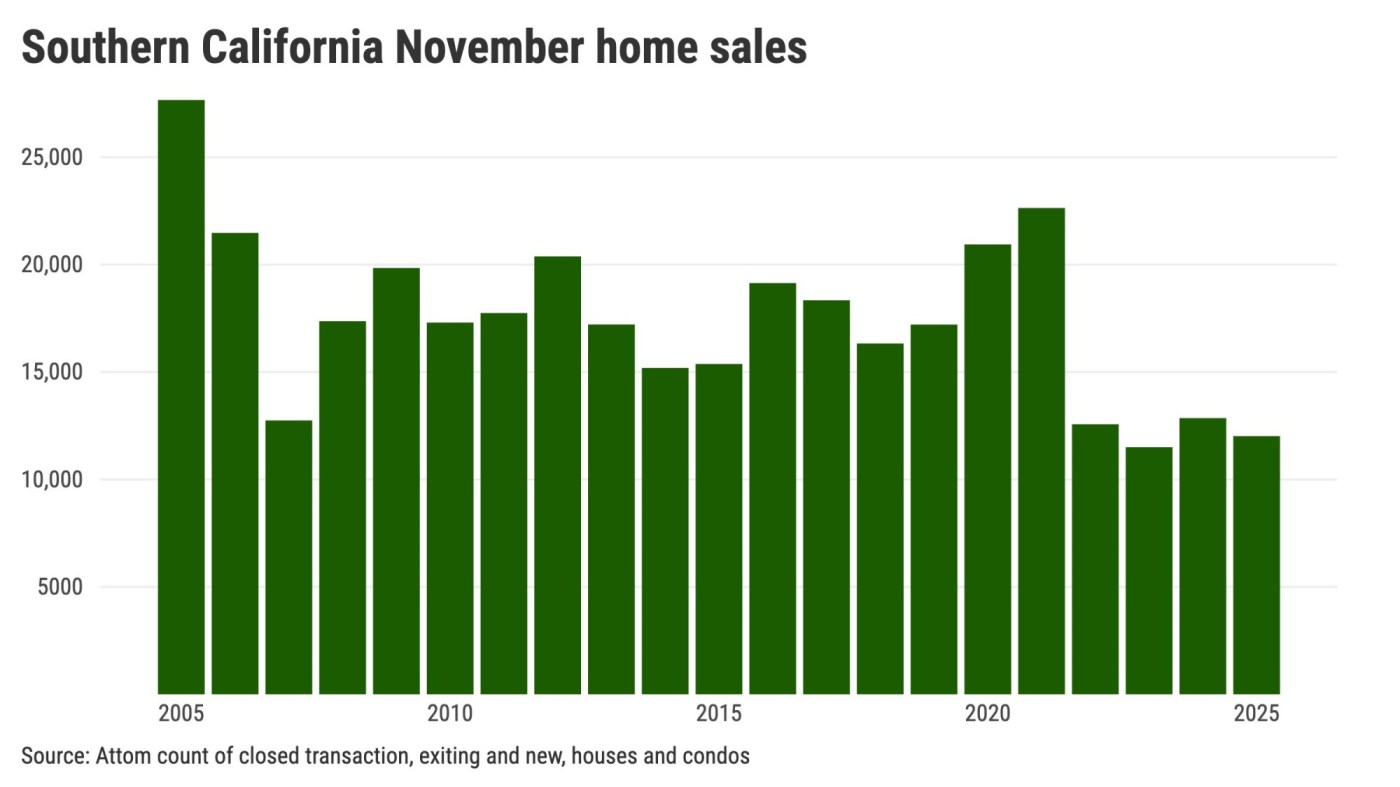

Southern California homebuying dropped to its second-slowest pace for a November over the past 21 years despite the lowest mortgage rates in three years.

Six local counties had 12,017 existing and newly built homes sold — both houses and condos — according to Attom data dating to 2005.

The only slower-selling November in the past 21 years was in 2023. So purchases have been even more depressed than during the dark days of the Great Recession in 2008-09.

Today, house hunters balk at lofty pricing. The buying total has dropped 7% over the last 12 months and is 32% below average, according to statistics dating back to 2005.

Or think of the long-running slump this way.

Sales during the past three years ran at a 13,836-a-month pace. That’s 32% slower than seen over the previous 18 years.

Wannabe owners were unmotivated by some rate relief in late autumn.

Mortgage rates averaged 6.3% in the three months ended in November, down from 6.5% a year earlier and the recent peak of 7.4% in November 2022. And in early 2026, mortgages have fallen to 6%.

Still, Southern California’s pricing remains stubbornly high.

The region’s $812,000 median sales price in November was up 1.5% year-over-year and sits just 3% below the $833,000 peak set in June 2025.

Even adding more options for buyers seeking an existing home didn’t make much of a difference.

For example, Southern California had an average of 38,000 homes listed for sale over the three months ending in November, according to Realtor.com. That was up 17% in a year, though it was 8% below supply in pre-pandemic 2019.

Why didn’t the late 2025 dip in rates immediately boost sales?

Let’s take a brief history lesson.

The Federal Reserve slashed the interest rates it controls during the pandemic’s 2020-2022 economic upheaval. Mortgage rates hit historic lows, with the three-month average tumbling to 2.73% in January 2021. That cheap money overheated the housing market.

In early 2022, the Fed’s policy reversed when inflation hit a four-decade high. The cost of living — and home sale prices — slowly cooled.

Last year, another change in Fed thinking nudged rates lower as concerns swirled about an ailing job market. And economic uncertainty is rarely good for homebuying.

Still, those gyrations translated into Southern California home prices rising 12% over the past three years vs. 33% gains in 2019-2022.

Who’s got $4,012 a month to buy a home?

That’s a typical buyer’s estimated mortgage payment at November’s median price, when it was financed at rates at lows not seen since 2022.

Yes, this payment index is 8% below its June 2025 peak. Yet this house hunter’s monthly financial burden remains double what it was six years ago.

Plus, you’d need a 20% down payment to get such a deal. That’s another $162,000 a buyers must have to purchase the typical home.

Also, this calculation does not include other recurring ownership costs such as property taxes, insurance or maintenance.

It’s not just Southern California — low sales vs. high prices.

Statewide, November’s 23,317 sales were the second-slowest total for the month over 21 years. California’s $735,000 median is only 2% below its all-time high set in June 2025.

Nationwide, 269,665 homes sold, fourth-lowest count over 21 years. The $365,000 U.S. median is just 1% below its June 2025 record.

Here is how the sales stall looked across the region’s six counties, ranked by the depth of the historical sales drop …

San Bernardino: 1,443 sales in November, the county’s slowest November over the past 21 years. The month’s median of $525,000 is 4% below the all-time high set in October 2024.

San Diego: 1,913 sales, No. 2 slowest, with a $872,000 median, 5% below the June 2024 peak.

Los Angeles: 4,507 sales, No. 2 slowest, with a $888,000 median, 3% below the June 2025 peak.

Riverside: 1,893 sales, No. 2 slowest, with a $599,000 median, which is 3% below the April 2025 peak.

Orange: 1,746 sales, No. 3 slowest, with a $1.16 million median, 5% below the June 2025 peak.

Ventura: 515 sales, No. 5 slowest, with a $850,000 median, which is 4% below the June 2025 peak.