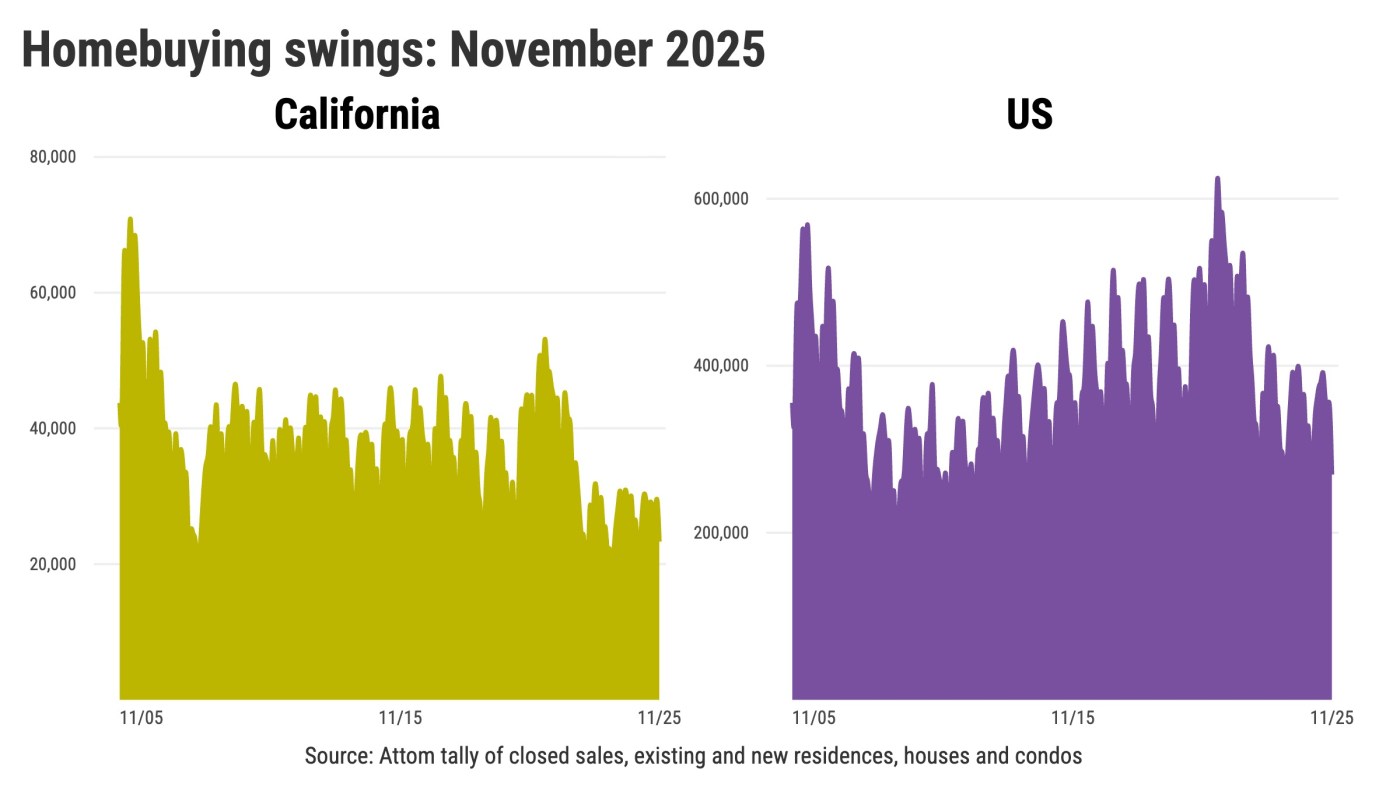

Americans bought homes at the fourth-slowest pace for a November in a 21-year history, despite the lowest mortgage rates in three years.

Nationally, 269,665 residences were sold in November. That’s existing homes and newly built properties – both houses and condos, according to Attom data dating to 2005. This broad tally of sales is off 13% over 12 months and 18% below average.

It’s no short-run slip. Sales over the past three years averaged 340,913 per month, 8% below the pace of the previous 18 years.

Contemplate the economic swings behind the sales collapse.

Mortgage rates averaged 6.3% in the three months ended in November, according to Freddie Mac. That’s down from 6.5% a year earlier and the recent peak of 7.4% in November 2022, when the national economy was overheated. Previously, rates tumbled to 2.73% in January 2021 when coronavirus darkened economic prospects.

In an affordability-challenged nation, why didn’t the year-end rate dip boost sales?

Well, cheaper financing can be tied to a wobbly business climate. Economic uncertainty is not good for homebuying.

Plus, nationwide pricing remains stubbornly high.

The $365,000 median sales price for November was up 2.8% in a year and sits just 1% below the $370,000 peak set in June 2025.

The good news for house hunters is that appreciation has cooled. Prices are up 14% during the past three years vs. 36% in 2019-2022.

Who’s got $1,804 a month to buy a home?

That’s an estimated mortgage payment an American buyer would get at November’s median price – even with the cheapest rates since 2022.

Yes, the U.S. buying burden is 7% below its peak in June 2024. However, payments are also up 108% in six years.

This math does not include other recurring ownership costs, such as property taxes, insurance, maintenance, or association fees.

Also, keep in mind the $73,000 down payment needed to make this deal work.